So despite not being seen as offering major cost-saving, outsourcing still surely is used by some organizations for cost-reductions (although with these often already implemented, improvements are likely harder to see). But now, other benefits that are much harder to quantify as cost-savings, such as the flexibility outsourcing provides, may be more important.

Trend seven: Outsourcing is becoming more strategic

There are risks to high levels of outsourcing. Outsourcing can leave companies with fewer real assets, inadequate bioprocessing facilities and staff lacking needed in-house expertise. When activities that were previously considered essential to retain in-house become options for outsourcing, the calculus moves beyond a simple short-term balance sheet analysis and instead turns to a study of the long term outcomes, since R&D cycles and production build outs are lengthy and risk-intensive. In this context, it is the additional strategic benefits, beyond just cost savings, that outsourcing can bring to drug development and manufacture that often swing decisions.

Those benefits must be weighed against the problems that come with reduced in-house capabilities and expertise that accompany outsourcing: these problems include companies having to hire CMOs and consultants to find and fix problems that classically would or should be resolved by in-house staff, with this potentially being costly. Other problems can arise, such as a lack of consistency in bioprocessing and regulatory documentation, which in turn lead to delays in product development, approvals, and manufacturing.

Trend eight: Offshoring is part of the strategic decision

Companies appear increasingly willing to trust partners beyond those local to them. In fact, in last year’s study, only 7% of respondents said that their CMO partner being local to them was a very important issue. Location of CMOs has never been important to facilities, with just 1 in 10 considering it very important back in 2006.

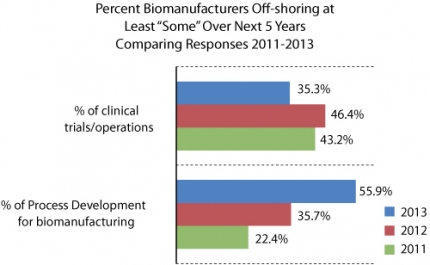

Data from the BioPlan study supports a growing trend towards international outsourcing of some activities. Responses were evaluated from 2011 to 2013 regarding the percentage of biomanufacturers that plan, within the next five years, to offshore at least some of various indicated activities ranging from process development to clinical trials and operations (see Figure 4). Significant growth was found in process development, a 33.5% numerical and 250% relative increase from 22.4% in 2011 to 55.9% this past year. Process development was the only area where over half of respondents plan to offshore in the next five years (although with increased emphasis on QbD and related quality issues, one would presume less offshoring of process design). Areas associated with biomanufacturing operations indicated a relatively smaller but still solid overall increase in expectations for offshoring, rising from 37.6% in 2011 to 50% in 2013.

Trend nine: Emerging markets a bigger part of the equation

Biopharmaceutical facilities are being built by local companies in developing countries to serve their domestic, regional, or lesser-regulated international markets. Markets for biopharmaceuticals are growing in many developing countries, such as India and China, with increased incomes, a new middle class and improved healthcare. Indeed, China (8.6%) and India (8.1%) together account for about one-sixth of global capacity. Factor in hubs in other Asian countries (9.7%) and Latin America (6.6%), and these emerging regions now hold a combined third of estimated global concentration of bioprocessing capacity, employment and productivity (2).

It’s true that these regions have yet to provide the institutional knowledge, facilities, and quality systems to compete in terms of commercial cGMP manufacturing infrastructure, and they have yet to contribute substantially in terms of manufacturing products marketed in the US and European Union. However, products made in India by Biocon may soon become available in European markets, and multiple South Korean companies can be expected to be among the leaders in launching biosimilars in the United States and EU markets. But China, Singapore, and other countries may have a long way to go, perhaps another decade, before substantially providing products/APIs for the EU and US markets. These countries, however, have become attractive destinations for outsourcing over time, and there’s reason to believe that they will grow to become more competitive with the established players.

Trend ten: Better communication enables better outsourcing

Data point to a growing comfort on the part of biomanufacturers with strategically outsourcing core activities—and with the potential to contract this business out to companies in emerging locations. Ultimately, though, these broad trends will only take root if both partners are comfortable with the relationship

Indeed, as outsourcing becomes more complex, and less familiar, clients and their partners will need to work harder than ever to ensure that they are able to communicate effectively to sort out any real and potential issues. The biomanufacturing community seems to recognize the importance of these “soft issues.” When asked to choose from a list of issues they consider “very important” when considering outsourcing to a CMO, a leading 53% cited “stick to a schedule.” Roughly half also cited “establish a good working relationship.”

These issues have little to do with the type of activity being outsourced or the country they are being outsourced to. What they do indicate is that for international outsourcing—of highly technical activities nonetheless—to become a more seamless proposition for companies and their clients, both parties will need to pay good attention to the underlying relationships that will make their partnerships a win for both sides.

References

1. BioPlan Associates,10th Annual Report and Survey of Biopharmaceutical Manufacturing Capacity and Production (Rockville, MD, April 2013).

2. BioPlan Associates,BioPlan’s Top 1000 Global Biopharmaceutical Facilities Index, Accessed Dec. 22, 2013.

Eric S. Langer is president and managing partner at BioPlan Associates, Inc., [email protected].