The US lags behind Europe with respect to establishment of a biosimilar pathway. While a pathway has been in place since March 2010, a lack of guidance from FDA regarding specific requirements has created significant uncertainty for biosimilar manufacturers. That uncertainty was somewhat alleviated in 2012, when the agency published draft guidance documents on how to demonstrate biosimilarity and the data that can be used to assess biosimilarity, as well as advice on the development process and working with FDA. Additional guidance on the substitution of biosimilars for branded products is also expected. In 2013, the agency launched its biosimilar user fee program.

In the guidance documents, FDA emphasizes interactions between the agency and biosimilar manufacturers and indicates that each product will be evaluated on a case-by-case basis. While this approach gives biosimilar producers more flexibility, it may also lack the level of detail they need to feel comfortable about investing in product development for the US market. Companies are also faced with possible state-level regulations on the substitution of biosimilars for branded drugs, as recently observed in California.

In Asia-Pacific, Japan also has an established regulatory pathway for biosimilars, and several products have been launched there. South Korea has an approval process as well. In 2013, the Therapeutic Goods Administration in Australia issued guidance for biosimilar approvals.

“Many emerging market countries are actively developing pathways for biosimilar approvals and are rapidly catching up. Brazil, Mexico, Venezuela, Columbia, and India now have at least draft, if not established, regulations for biosimilar approval in place. Russia is also developing an approval pathway, as are countries across Asia and Africa. The China Food and Drug Administration has also begun discussions on the development of a biosimilar approval process,” observes Santos da Silva.

Each of these approval pathways is different, though, even in the developed countries, where they tend to be very strict. “Manufacturers are required to plan clinical trials and development processes to satisfy various stringent regulations applicable for each distinct country. Consequently, Celltrion employees and executives have thoroughly reviewed the guidelines of every relevant country and managed the details of our biosimilar mAb development strategy with these requirements in mind from the very beginning,” says Kim.

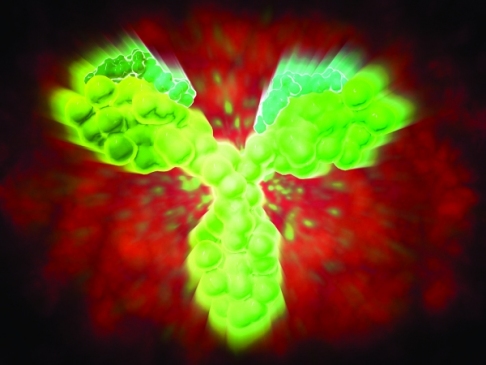

Because of the nature of biosimilars, including mAbs, regulatory determinations do need to be made on a case-by-case basis. “Each evaluation must be specific to the innovator product and the biosimilar product from a specific company and consider the characteristics of each and how closely they are matched,” explains Keeping. She adds that it is the totality of evidence that is crucial when determining biosimilarity, because differences are expected. It is the job of the biosimilar sponsor to demonstrate that the differences result in no clinically meaningful effect on quality, safety, or efficacy compared to that of the innovator drug.

A clear step-wise process for characterizing the reference product and biosimilar to compare the physico-chemical properties, conducting clinical trial evaluations to determine comparable therapeutics performance, and evaluating the weight of the evidence and determining whether identified differences affect efficacy and safety is crucial for speeding up the approval process and lowering the cost of bringing biosimilars to market.