In a recent survey of current trends and practices in biopharmaceutical manufacturing, BioPharm International readers revealed a preference for disposable systems, identified challenges for different therapies, and suggested technology enhancements to improve process efficiencies (1).

In a recent survey of current trends and practices in biopharmaceutical manufacturing, BioPharm International readers revealed a preference for disposable systems, identified challenges for different therapies, and suggested technology enhancements to improve process efficiencies (1).

Survey respondents represented research, development, formulation, and process development functions, as well as quality control/assurance, validation, and laboratory management titles at branded and generic-drug companies in the United States, Europe, and Asia. More than half of the respondents work for organizations that produce both small- and large-molecule drugs; 25% added a biopharmaceutical-manufacturing program in the past year.

The responses indicate some signs of manufacturing growth. More than half of all respondents said their companies increased biomanufacturing capacity in 2013. Less than 3% reported a drop in production. Only 8.1% said their companies decreased spending for biopharmaceutical equipment and services in 2013 compared to 2012; 37.8% reported increased spending; spending was flat for 33.8% of respondents. Nearly 40% expect spending to increase in 2014 compared to 2013; only 5.4% expect a decrease.

The top reasons for increased capacity were the addition of new products and increased production of existing products. More than 40% of respondents said that internal development of new products spurred the need for additional capacity. About 20% said capacity was added due to the acquisition of another company or in-licensing of a drug product

Almost 45% of the respondents reported that their organizations manufacture therapeutic monoclonal antibodies (mAbs); more than 55% of those surveyed said they manufacture protein-based drugs other than mAbs. More than 40% of the respondents said their companies manufacture vaccines; 17.7% develop cells for tissue and/or cell therapies; 10.4% manufacture nucleic-acid based drugs.

Challenges: Protein-based drugs. Facilities that manufacture protein-based drugs reported use of multiple purification technologies. Ion-exchange chromatography was the most frequently reported (71.6%) followed by chromatography with other resins (62.7%), chromatography with Protein A (56.7%), and membrane-based filters (53.7%).

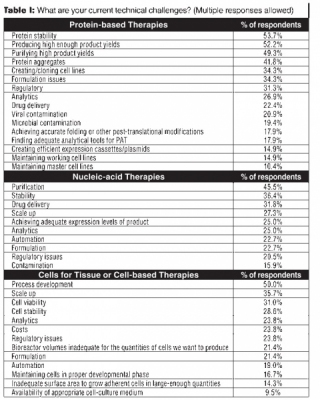

Protein stability led the list of reported technical challenges, cited by 53.7% of the respondents. Producing sufficiently high product yields was a close second at 52.2%; purifying high product yields was the third most frequently cited at 49.3%. Protein aggregates, formulation issues, creating/cloning cell lines, regulatory issues, and analytics were mentioned by more than 25% of the respondents (see Table I).

Nucleic-acid based drugs. Although they represented a smaller subset of the respondents, those that manufacture nucleic-acid based drugs reported multiple manufacturing challenges. Purification (reported by 45.5%), stability (36.4%), drug delivery (31.8%), and scale up (27.3%) led the list (see Table I).

Cells for tissue or cell-based therapies. Process development for cells for tissue- or cell-based therapies created technical challenges for half of the respondents. Scale up (35.7%), cell viability (31%), and cell stability (28.6%) were also listed as top technical issues. Regulatory issues, costs, analytics, and inadequate bioreactor volumes were other challenges (see Table I).